The Kenyan electricity sector has seen several waves of structural reforms that have seen the unbundling of KPLC and Lighting companies to create KenGen, KETRACO, later GDC and REREC. These have been done to separate business units and thereby have specific focus and competition in the areas of generation, transmission, resource development and rural electrification respectively.

Nevertheless, a clamour for more reforms persists. This has been explicitly directed towards the introduction of competition to KPLC in the distribution and retail business. The Progressive Energy Act 2019 envisioned this by defining licensees in generation, transmission, and distribution. The Act also foresaw a possibility of counties being engaged in the extension of power at the ends of the grids through reticulation.

KPLC today, as the single buyer, carries the burden of supporting the collection of revenues from the sale of electricity that supports the entire sector. This has been widely understood from the recently approved tariff review. Any attempt at opening for competition must consider this burden or otherwise risk revenue requirement to meet KPLC obligations. This simply means that we must guarantee KPLC a certain level of income to pay for long-term liabilities in the form of contracts and loans entered by the company to secure the present and long-term electricity needs of the country. This is only logical to ensure that as we open for competition, we ensure KPLC does not default in obligations it took out for the benefit of the country.

At the same time, we need to enable the different business models that investors seek to deploy in Kenya to have a chance to participate in the market. Investors are looking to produce power at one location and wheel the power to another location where a dedicated demand is set up. Investors and consumers are looking to install their own generation onsite to support supply from KPLC, and yet others are looking to export power to neighbouring countries. These, should they be allowed without careful consideration, are thought to lead to tough times for KPLC. This has been the main sticking point in getting the necessary modalities in place for competition.

A midway point is required between the structure Kenya currently has and a fully open and competitive market. Luckily, there exists such a structure that caters to the desire to have more competition while also ensuring that KPLC’s deserved revenues for obligations taken on the nation’s behalf are met for their remaining period. The structure is a partial opening of the electricity market in the form of a modified single-buyer market as developed and practised in Namibia.

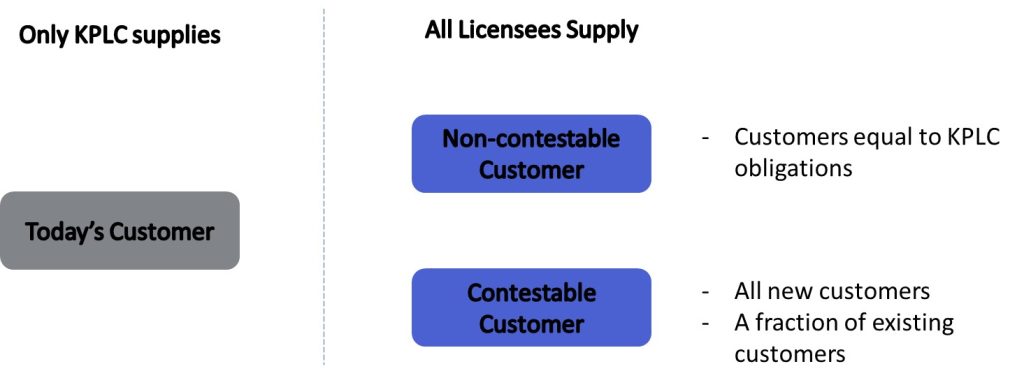

In this structure, there is the delineation of a contestable and non-contestable customer. The former is one that KPLC and other licensees can compete to supply, while the latter is a customer that is dedicated to KPLC for a given period. This period can be defined as the remaining term of the newest PPA and loan, with the release of customers from the non-contestable status being in proportion to the expiry of PPA and loan obligations.

For example, if KPLC has 30% of its PPA and loan obligations ending within the next ten years, then at the 10-year point, 30% of customers can be declared contestable working up to the point where all obligations from the decision date are released, and all customers can be contestable. All new customers as of the date of the decision can be contestable.

KPLC must also be allowed to compete for contestable customers, allowing the company to progressively improve on its efficiencies while being shielded to allow it to meet its obligations. At the beginning of this scheme, KPLC could open its most challenging customers to supply to competition, allowing for innovative solutions to be developed to serve these customers by licensees. This would then transition progressively over a decade or so to a full-scale opening of the market.

There will be questions on the rights of non-contestable customers, social aspects of the KPLC supply, and the general security of supply to be answered to effect this change, but this is a path the country must evaluate.